Inheriting a house is both an emotional and complex situation. It is not simply about property or a real estate transaction—it is also a life moment often filled with family memories and sometimes grief. Becoming a homeowner, often unexpectedly, raises many questions: what should be done with this property, should it be sold, kept, or rented? Among these options, selling remains one of the most common paths. But before putting an inherited house on the market, it is essential to understand the steps to follow, the legal, fiscal, and administrative obligations, as well as the practical aspects that can make the process smoother.

The very first element to consider is the emotional aspect. Selling an inherited home often means closing an important chapter of your personal story. It is not a transaction like any other, since the property is usually tied to cherished memories. Before tackling the technical side, it is important to acknowledge that there will be an emotional dimension to this process. Some people find it helpful to take time to reflect before selling, just to manage the emotions attached to the place. Others prefer to act quickly, in order not to prolong a process that could reopen wounds. In any case, recognizing this emotional weight is important, as it will influence how you approach each step.

Then comes the legal and succession matters. Inheriting a house means that the property is part of an estate. Before any decision can be made, the estate must be settled—that is, the heirs must be officially recognized, and any debts from the estate must be accounted for. In many cases, this requires the involvement of a notary or lawyer, who ensures that everything is legally in order. The notary verifies the will, identifies the heirs, and ensures that the property transfer is properly registered. Without this step, the house cannot legally be sold, as proof of rightful ownership is required.

Once the legal side is resolved, another question arises: are you the sole heir, or do you share ownership with others? If multiple heirs are involved, an agreement must be reached. If everyone wants to sell, the process is relatively straightforward. However, sometimes one heir wants to keep or occupy the home, which complicates things. In such cases, clear communication is essential. Sometimes one heir will buy out the others, but if no agreement can be reached, selling is often the fairest solution.

After sorting out succession matters, attention shifts to the property itself. An inherited home is not always in perfect condition, especially if it has been unoccupied for some time. Before putting it on the market, it’s important to evaluate its overall condition. A pre-sale inspection can be a smart move, as it provides a clear picture of necessary repairs. This also helps in deciding whether to sell the house as-is, likely at a lower price, or invest in small upgrades that could increase its value. Simple improvements such as painting, refreshing flooring, or maximizing natural light can make a huge difference in attracting buyers.

The next step is preparing the home for sale. Inheriting a house doesn’t automatically mean it’s ready to charm buyers. Often, these homes are filled with personal belongings, furniture, and family keepsakes accumulated over the years. Sorting through everything is inevitable. This step can be emotionally difficult, as it forces you to revisit items loaded with memories, but it is essential. A cluttered house may discourage visitors, while a neutral and well-presented space helps buyers picture themselves living there. Even minimal home staging can make a big impact. Removing worn carpets, airing out rooms, and adding a few modern touches can make the home more attractive.

Once the property is prepared, it’s time to determine its market value. Because real estate markets constantly shift, setting a fair and competitive price is key. Emotional attachment can sometimes lead heirs to overestimate the value of the home. However, only the market dictates the price. This is where a real estate agent becomes an invaluable ally. An agent can analyze comparable sales in the neighborhood, evaluate demand, and propose an effective marketing strategy. They can also advise whether improvements are worthwhile or if the house should be sold in its current state.

Another often-overlooked aspect is taxation. Contrary to popular belief, inheriting property in Canada does not involve inheritance taxes. However, the property is treated as though it was sold by the deceased at fair market value, which may trigger capital gains tax, especially if it was not their primary residence. This is a crucial point to review with a notary or accountant to avoid unpleasant surprises during the sale process.

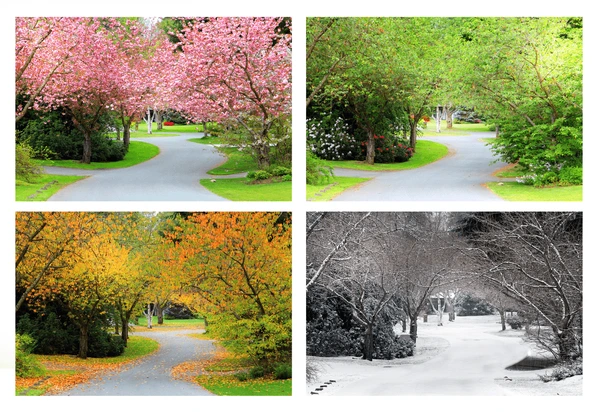

With everything in place, it’s finally time to put the house on the market. Timing can play an important role. Certain seasons, such as spring, tend to be more favorable, but the best time also depends on your local market conditions and personal circumstances. A real estate agent can guide you on timing to maximize your chances. During showings, presenting the house as clean, welcoming, and neutral is vital. Buyers are looking for a place to imagine their own future, not to step into someone else’s family history.

Selling an inherited house can sometimes take longer than expected, particularly if it needs renovations or is located in an area with lower demand. Patience is key. However, with proper preparation and guidance, this process can be turned into a positive opportunity.

Ultimately, an inherited home is more than just a property—it is a legacy. Selling it is also a way of honoring the memory of the person who left it to you, by allowing the home to carry value into your own life. This could be through the financial benefit of the sale, the chance to invest in a new project, or simply the peace of mind gained once the process is complete.

In conclusion, selling an inherited house requires both organization and reflection. From managing legal matters and preparing the home, to setting the right price and navigating the sale, each step plays a crucial role in the success of the transaction. Surrounding yourself with the right professionals—lawyers, notaries, real estate agents, tax advisors—makes all the difference. While it may feel overwhelming at first, every carefully made decision brings you closer to a successful sale and turns this legacy into the beginning of a new chapter in your life.